Table of Contents

- Apollo Global Management :: Behance

- Apollo Global Management, Inc. Logo Editorial Stock Photo - Image of ...

- Apollo’s Rare Emissions Disclosure Offers Clue to CO2 Challenge - Bloomberg

- Apollo Global Management Office Photos

- Apollo Global Management, Inc. on LinkedIn: “As markets retrench, this ...

- Apollo Global Management Investor Presentation Deck | Slidebook.io

- Apollo Global Management, Inc. Logo Vector - (.SVG + .PNG) - GetLogo.Net

- HOK for Apollo Global Management

- Apollo Global Management (APO) Investor Presentation - Slideshow ...

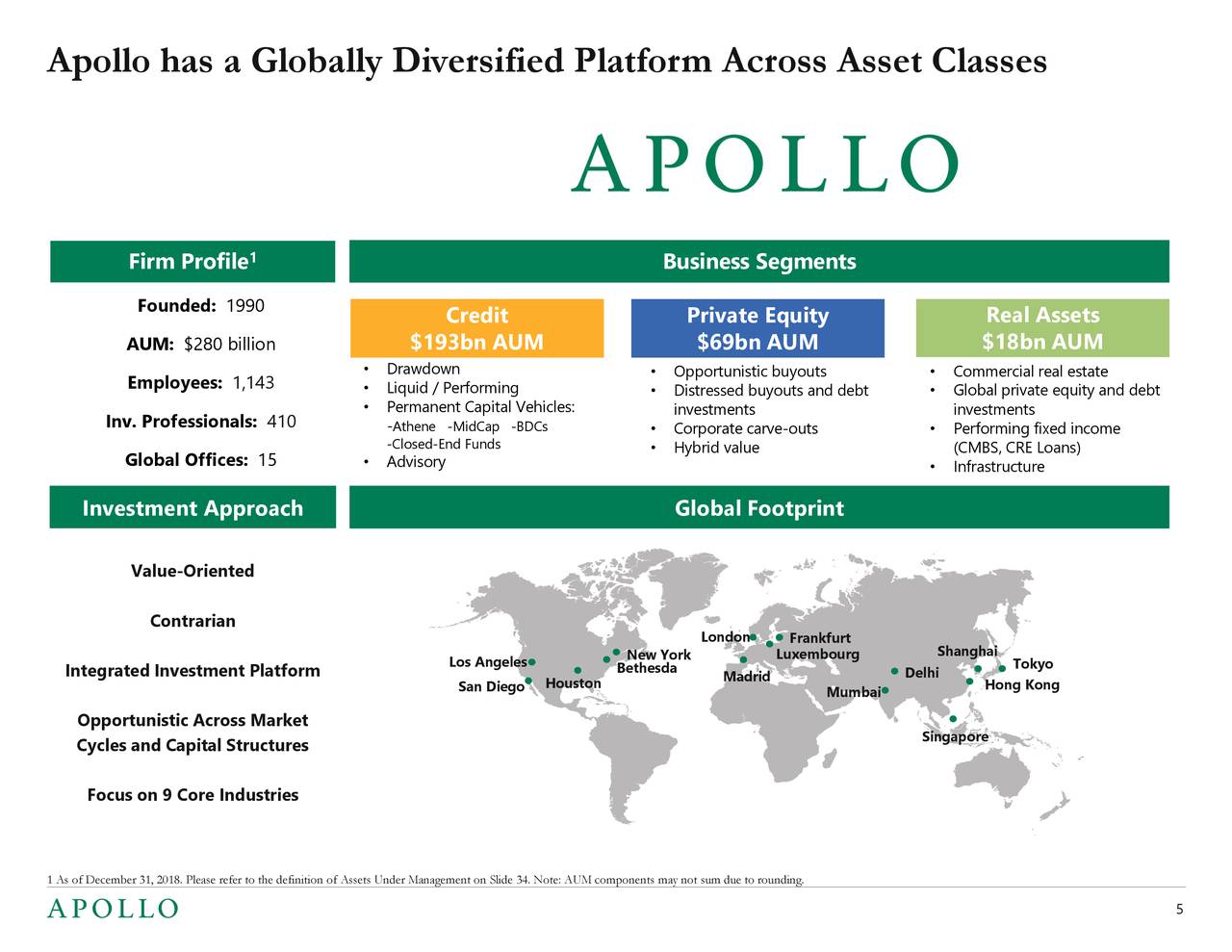

- Why Apollo Global Management for Private Equity? / Overview of Apollo ...

Understanding Apollo Global Management, Inc. (NYSE:APO)

Significant Share Acquisition

Implications for Investors

The acquisition of Apollo Global Management, Inc. (NYSE:APO) shares is likely to have significant implications for investors. On one hand, the increased demand for the company's shares may lead to a surge in stock price, providing existing investors with potential capital gains. On the other hand, new investors may view this development as an opportunity to enter the market, potentially driving up the stock price further. However, it is essential for investors to exercise caution and conduct thorough research before making any investment decisions. The acquisition of shares by a significant investor or institution may not necessarily guarantee future success or growth. Investors should carefully evaluate the company's financial performance, industry trends, and competitive landscape before investing in Apollo Global Management, Inc. (NYSE:APO).

Market Outlook

The recent acquisition of Apollo Global Management, Inc. (NYSE:APO) shares is expected to have a positive impact on the company's market outlook. As the global economy continues to recover from the COVID-19 pandemic, alternative investment managers like Apollo Global Management are likely to play a crucial role in shaping the investment landscape. With its diverse range of investment strategies and strong track record, the company is well-positioned to capitalize on emerging opportunities and drive growth. In conclusion, the significant acquisition of Apollo Global Management, Inc. (NYSE:APO) shares is a notable development that is likely to have far-reaching implications for investors and the company alike. As the investment landscape continues to evolve, it is essential for investors to stay informed and adapt to changing market conditions. With its strong market position and diverse investment strategies, Apollo Global Management, Inc. (NYSE:APO) is an attractive option for investors seeking to capitalize on emerging opportunities in the alternative investment space.Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Investors should conduct thorough research and consult with financial experts before making any investment decisions.