Table of Contents

- 2025 Irmaa Brackets Based On 2025 Income 2025 - Zihna Skye

- 2025 Irmaa Brackets Part B - Megan Butler

- 2025 Irmaa Brackets Based On 2025 Income Limit - Denna Tamarra

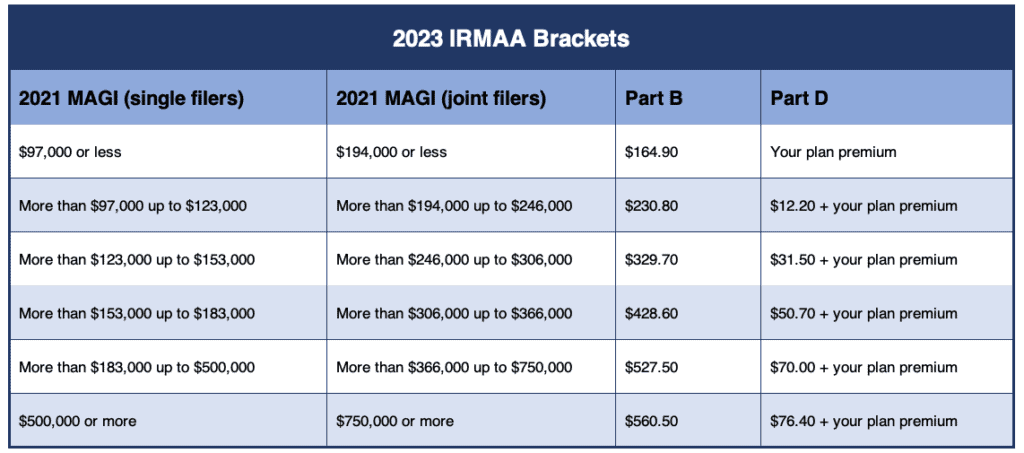

- The 2023 IRMAA Brackets - Social Security Intelligence

- The IRMAA Brackets for 2023 - Social Security Genius

- Possible 2025 IRMAA Brackets

- 2025 Irmaa Brackets Based On 2025 Income 2025 - Zihna Skye

- 2025 Irmaa Brackets Based On 2025 Income 2025 - Zihna Skye

- 2025 Irmaa Brackets Based On 2025 Income Limit - Denna Tamarra

- The IRMAA Brackets for 2023 - Social Security Genius

What is IRMAA?

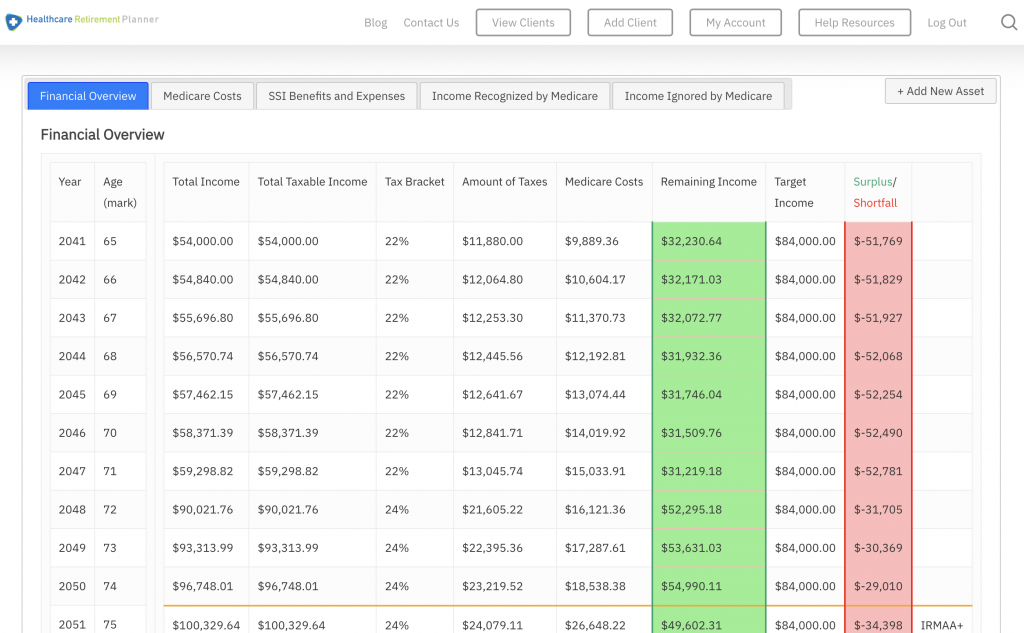

2024 IRMAA Income Brackets

2025 IRMAA Income Brackets

The 2025 IRMAA income brackets are expected to be: Less than $100,000: No IRMAA surcharge applies $100,000 - $127,000: 40% surcharge $127,001 - $159,000: 60% surcharge $159,001 - $191,000: 80% surcharge $191,001 - $238,000: 100% surcharge More than $238,000: 150% surcharge For joint filers, the income brackets are: Less than $200,000: No IRMAA surcharge applies $200,000 - $254,000: 40% surcharge $254,001 - $318,000: 60% surcharge $318,001 - $382,000: 80% surcharge $382,001 - $476,000: 100% surcharge More than $476,000: 150% surcharge Understanding the IRMAA 2024 and 2025 income brackets is crucial for individuals who want to plan their Medicare expenses. By knowing how the IRMAA surcharge is calculated and what income brackets apply, you can make informed decisions about your Medicare coverage. If you have any questions or concerns about IRMAA or Medicare, it's always best to consult with a licensed insurance professional or a Medicare expert. Remember, it's essential to review your income and Medicare premiums annually to ensure you're not overpaying for your coverage. Stay informed, and take control of your Medicare expenses.Source: Healthline